Current yield calculation

Interest rate on the financial instrument of each component currency in the SDR basket expressed as an equivalent annual bond yield. We can start with the current yield calculation as that will be a much easier task.

How To Calculate Yield To Maturity In Excel Free Excel Template

Its not risky but it is also not very safe.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

. A calculation of your long-term. Current yield is usually calculated for bonds where the annual income is the coupon paid out but the yield could also be calculated for stocks where the annual income is the dividend paid out or really for any asset that pays out annually. You can learn more about financial analysis from the following articles.

If RBI issues a 91- Day treasury bill at the discounted price of Rs97 while the face value of the bill is Rs100 the yield of the security can be determined as follows. You calculate current yield by dividing the annual interest earnings by the current market price of the bond 5 110 in this case. Hence it is clear that if bond price decrease bond yield increase.

Current yield is an investments annual income interest or dividends divided by the current price of the security. The limits are estimates based on expected product loss. As you can see we have assumed that the current market value of Bond X is lower than the Face Value which indicates that it is trading at a discount.

The trailing 12-month yield is the average return a fund gave over the past 12 months. Decrease it by one tenth of a point to 68 percent 34 percent semi-annual plug that into the formula and you get 9592. The Yield to Maturity of this bond calculated.

58 The reconciliation calculation is based on actual figures. 510 Return the left over product- specific empty hard gelatin capsules in properly labeled and packed condition to warehouse department with Goods Return. Three-month benchmark yield for China Treasury bonds as published by China Central Depository and Clearing Co.

Here we discuss how to calculate bond yield along with practical examples and a downloadable excel template. 59 Reconcile the batch yield at the end of manufacturing process. For example when you plug in 69 percent 345 percent semi-annual you get a P of 9570.

Yield to Maturity Calculation of a Bond. For any process it is ideal for that process to produce its product without defects and without rework. A ratio of 1 is usually considered the middle ground.

Youre getting close but its not exactly correct yet. Three-month spot rate for euro area central government bonds with a rating of AA and above published. How it is Done.

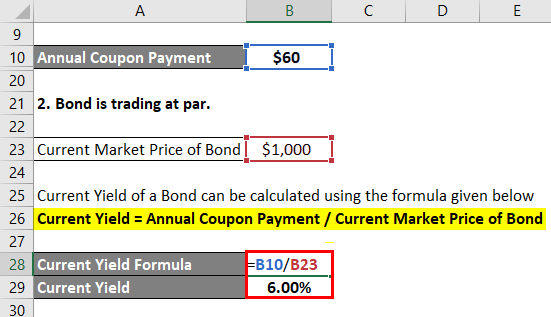

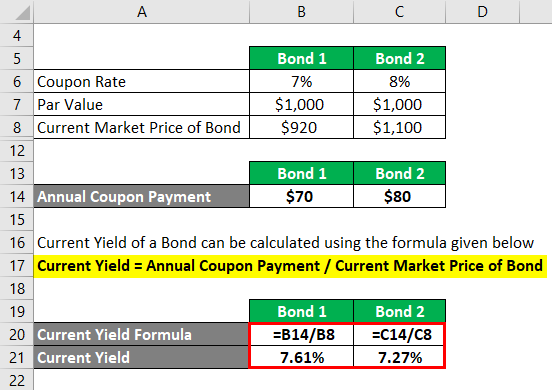

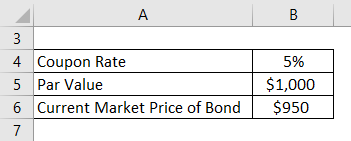

Subtract 100 minus the ask price and. Annual coupon payment Current market price 100 950 1053 Scenario 2. The current yield calculation helps investors drill down on bonds that generate the greatest returns on investment each year.

Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable. Lets understand this with an illustration. Premium bond Premium Bond A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value.

A WCR of 1 indicates the current assets equal current liabilities. This occurs when a bonds coupon rate surpasses its prevailing market rate of interest. Returns on single stocks are calculated by dividing the total returns the stock paid out by the stocks market price.

This is especially helpful for short-term investments. This measure looks at the current price of a bond instead of its face value. P The discounted price of the T-bill purchased.

Y Yield return percentage of T-bill. D Tenure of T-bill. It differs from the returns that one stock gives.

This has been a guide to Bond Yield Formula. Yield to Maturity YTM acts as an indicator of potential returns from a Debt Fund. Rolled throughput yield RTY in production economics is the probability that a process with more than one step will produce a defect free unit.

Yield to call YTC. It is the product of yields for each process step of the entire process. The current yield interest yield income yield flat yield market yield mark to market yield or running yield is a financial term used in reference to bonds and other fixed-interest securities such as giltsIt is the ratio of the annual interest payment and the bonds price.

According to Investopedia the clean market price of the bond should be the denominator in this calculation. TTM Yield Definition and Calculation. This will give you a precise calculation of the yield to maturity.

Doing the calculation In order to calculate the yield start with the quoted ask price which is typically stated in terms that assume a face value of 100.

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

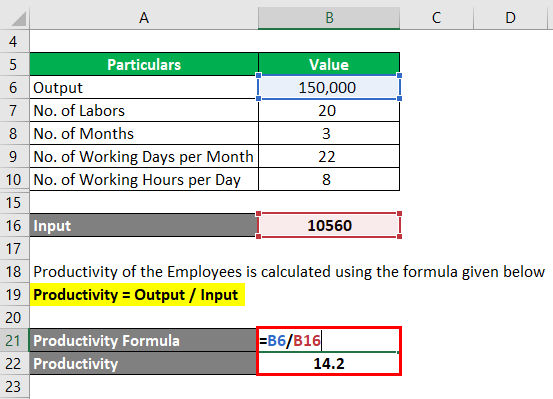

Productivity Formula How To Calculate Productivity With Examples

Current Yield Formula Calculator Examples With Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Yield Calculator

Yield To Maturity Approximate Formula With Calculator

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Current Yield Formula Calculator Examples With Excel Template

Yield To Maturity Ytm Formula And Calculator Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Current Yield Meaning Importance Formula And More

6 Of 16 Ch 7 Calculating Current Yield Youtube

Current Yield Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Ytm Formula And Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template